Taxes

What does it mean to be a Tax Resident in Singapore?

Did you know? All income earned in Singapore is taxable.

You are a tax resident for a particular Year of Assessment if you are a:

Singapore Citizen or Singapore Permanent Resident (SPR)

-

who normally resides in Singapore except for temporary absences

Foreigner who has stayed/worked in Singapore

-

for at least 183 days in the previous calendar year; or

-

continuously for 3 consecutive years

A foreigner who has worked in Singapore

-

for a continuous period straddling 2 calendar years and your total period of stay* is at least 183 days.

*including your physical presence immediately before and after your employment.

Foreigners issued with a work pass that is valid for at least 1 year will also be treated as a tax resident. However, your tax residency status will be reviewed at the point of tax clearance when you cease your employment based on the tax residency rules. If your stay in Singapore is less than 183 days, you will be regarded as a non-resident.

Read more at the IRAS website.

Overall Tax Structure in Singapore

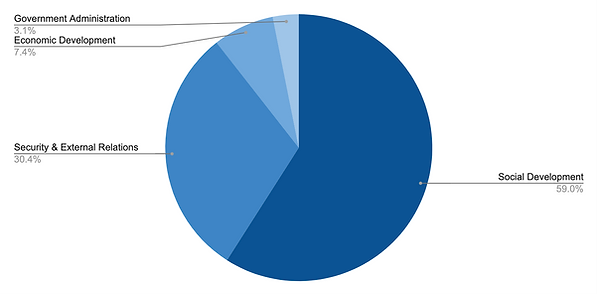

Taxes are used to develop Singapore into a stronger community, a better environment, and a more vibrant economy. Taxes go to the funding of government expenditure. In FY2020/21, the largest sector making up the Government Operating Expenditure was the Social Development Sector.

Government Operating Expenditure 2023

Source: Economic Survey of Singapore, Third Quarter 2023

Type of Taxes in Singapore

Tax Exemption/Benefits

Income Tax

The amount of income tax you need to pay depends on:

-

how much you earn in Singapore; and

-

whether you are a tax resident or non-resident for income tax purposes.

Rates (Residents)

Rates (Non-Residents)

Taxes on employment income

The employment income of non-residents is taxed at the flat rate of 15% or the progressive resident tax rates (see table above), whichever is the higher tax amount.

Taxes on director's fee, consultation fees and all other income

The tax rate for non-resident individuals is currently at 22%. It applies to all income including rental income from properties, pension and director's fees, except employment income and certain income taxable at reduced withholding rates.

You may also use the Tax Calculator for Non-Resident Individuals (XLS, 91KB) to estimate your tax payable.

Corporate Income Tax

Your company is taxed at a flat rate of 17% of its chargeable income. This applies to both local and foreign companies.

The government provides rebates to companies to ease their business costs and to support their restructuring.

Please refer to IRAS’ website for more information.

Goods & Services Tax

GST is a tax on consumption. The tax is paid when money is spent on goods or services, including imports. Since 2007, Singapore has imposed a GST of 7%.

After 1 Jan 2023, purchases of goods and services will be subjected to GST at 8%.

Standard-Rated Supplies (7% GST)

Goods

-

Most local sales fall under this category.

E.g. sale of TV set in a Singapore retail shop

Imports of low-value goods (from 1 Jan 2023)

Services

-

Most local provision of services fall under this category.

E.g. provision of spa services to a customer in Singapore

Zero-Rated Supplies (0% GST)

Goods

-

Export of goods

E.g. sale of a laptop to an overseas customer, where the laptop is shipped to an overseas address

Services

-

Services that are classified as international services

E.g. air ticket from Singapore to Thailand (international transportation service)

Property Tax

Annual property tax is calculated by multiplying the Annual Value (AV) of the property by the Property Tax Rates that apply to you. The AV of buildings is the estimated gross annual rent of the property if it were to be rented out, excluding furniture, furnishings and maintenance fees. It is determined based on estimated market rentals of similar or comparable properties and not on the actual rental income received.

Non-residential properties such as commercial and industrial buildings and land are taxed at 10% of the Annual Value. Owner-occupier tax rates do not apply to non-residential properties even if you have bought the properties for your own use/occupation.

Any rent payments you receive when you rent out your property are subject to income tax and must be declared in your Income Tax Return.

Refer to IRAS’ website for more information.

Owner-occupier tax rates (residential properties)

.png)

.png)

Non-owner-occupier residential tax rates (residential properties)

.png)

.png)

Stamp Duty Tax

Stamp duty is a tax on documents relating to immovable properties, stocks or shares.

Stamp duty is computed based on the consideration or market value of the relevant asset, whichever is higher.

In recent years, stamp duty has been used as a property cooling measure in Singapore to ensure a stable and sustainable property market.

Restrictions

Buyer's Stamp Duty (BSD)

You are required to pay BSD for documents executed for the transfer or sale and purchase of property located in Singapore. BSD will be computed on the purchase price as stated in the document to be stamped or market value of the property (whichever is the higher amount).

You’ll have a higher tax rate when the property is more expensive. Right now, residential properties are taxed at 1% for the first $180,000; 2% for the next $180,000, 3% for the next $640,000; and 4% for the remaining amount.

Read more about BSD here.

Restrictions

Additional Buyer's Stamp Duty (ABSD)

Additional Buyer’s Stamp is another kind of tax on top of BSD. However, it only applies to Singapore Permanent Residents and foreigners, or Singaporean Citizens intending to buy more than one residential property in Singapore.

Unless you’re a Citizen or Permanent Resident of Iceland, Liechtenstein, Switzerland, or USA, you need to pay an additional 20% for each property that you buy.

On top of Buyer’s Stamp Duty (BSD), buyers are required to pay an Additional Buyer’s Stamp Duty (ABSD). The ABSD rates differ from foreigners to Permanent Residents.

For foreigners, buying any residential property subjects you to 30% ABSD on the purchase price or the market value of the property, whichever is the higher emount.

Meanwhile for PRs, buying your first, second and third residential property subjects you to 5%, 25% and 30% respectively.

Let’s say you have a residential property in mind, a condominium. The price is at SGD 1 million.

A 30% ABSD will be incurred on foreigners buying any residential property.

30100$1,000,000 = $300,000

Meanwhile, A 5% ABSD is incurred on PRs buying their first residential property.

5100$1,000,000 = $50,000

The difference is a whopping $250,000!

Motor Vehicle Tax

These are taxes, other than import duties, that are imposed on motor vehicles. These taxes are imposed to curb car ownership and road congestion.

Restrictions

Claiming Input Tax for Purchase

Motor car

The cost and running expenses of a motor car (except for Q-plated cars with COE issued before 1 Apr 1998) are disallowed expenses under Regulation 27 of the GST (General) Regulations. Hence, the GST incurred on the purchase and running expenses (e.g. petrol and parking expenses) of a motorcar is not claimable.

Other motor vehicles

For other motor vehicles (e.g. lorry, van, and motorcycle) that do not fall under the definition of a 'motor car', the GST incurred for the purchase and running expenses of the motor vehicles are claimable, subject to the conditions for input tax claim.

Restrictions

Charging Output Tax for Sale

If you are not a motor vehicle dealer, you should use the Discounted Sale Price Scheme when you occasionally sell a vehicle that you have used in your business.

Under this scheme, you are required to charge GST on 50% of the selling price when you sell the used vehicle.

Customs & Levied Tax

All dutiable goods imported into or manufactured in Singapore are subject to customs duty and/or excise duty.

Customs duty is duty levied on goods imported into Singapore, excluding excise duty. Excise duty is duty levied on goods manufactured in, or imported into, Singapore.

Duties & Dutiable Goods

The duties are based on ad valorem or specific rates. An ad valorem rate is a percentage of the goods’ customs value (for example, 20% of the customs value). A specific rate is a specified amount per unit of weight or other quantity (for example, S$388.00 per kilogram).

There are 4 categories of dutiable goods:

-

Intoxicating liquors

-

Tobacco products

-

Motor vehicles

-

Petroleum products and biodiesel blends

Please refer to the list of dutiable goods for their respective duty rates. All other products are non-dutiable. For more information on the calculation of duties, please refer to Singapore Customs’ website.

Betting Tax

After a person receives the approval from the Minister for Home Affairs and is gazetted by the Minister for Finance as an exempt organisation in the Betting and Sweepstake Duties Order, any amount received on bets by that person will be subject to duty under the Betting and Sweepstake Duties Act.

The following betting activities are subject to duty in Singapore:

-

Totalisator or pari-mutuel betting in connection with horse racing

-

Sports betting (e.g. football betting)

-

Sweepstakes

-

Any other system or method of cash or credit betting (e.g. 4D and Singapore Sweep)

Please refer to IRAS’ website for more information on the calculation of duty.

Estate Duty Tax

Estate duty is a tax on the total market value of a person's assets (cash and non-cash) at the date of his or her death. It does not matter if the person has a will or not, the assets are still subject to estate duty. Estate Duty has been removed for deaths on and after 15 Feb 2008.

The deceased person's assets, as a whole, are called an estate. For the majority of estates, there is no estate duty payable as various exemptions are provided.

A person's estate includes:

-

Everything owned in his or her sole name

-

The deceased person's share of assets owned jointly with others

-

Gifts made within five years before his or her date of death

-

Gifts made anytime from which he or she retains some benefits (e.g. collecting the monthly rental income from a house even though the house was given to someone else 10 years ago)

-

Assets held in trust from which he or she receives some personal benefit (e.g. bank accounts held in trust for children who are still minors)

Common Assets Subject to Estate Duty

-

Immovable Property

-

Immovable properties outside Singapore are not subject to Estate Duty in Singapore.

-

Bank Accounts

-

Public Listed Shares

-

Items in Safe Deposit Box

Refer to IRAS’ website for more information.

Casino Tax

The casino tax is a tax levied on the casinos’ gross gaming revenue.

Casino tax is computed monthly based on the Gross Gaming Revenue (GGR) from the games conducted in the casino.

Gross Gaming Revenue (GGR) = A - B

Other Taxes

Below are additional taxes that exists in Singapore that were not previously mentioned.

Restrictions

Foreign Worker Levy

If you employ Work Permit holders, you will have to pay a monthly levy for each worker.

The foreign worker levy, commonly known as “levy”, is a pricing mechanism to regulate the number of foreigners in Singapore.

You must pay a monthly levy for Work Permit holders. The levy liability will start from the day the Temporary Work Permit or Work Permit is issued, whichever is earlier. It ends when the permit is cancelled or expires.

Levy rate and quota

The levy you pay generally depends on two factors:

-

The worker’s qualifications.

-

The number of Work Permit or S Pass holders hired

Please refer to the Ministry of Manpower’s (MOM) website for more information.

Restrictions

Water Tax

There are three components to the water price in the monthly bill: water tariff, water conservation tax and waterborne fee.

Water Tariff

The Water Tariff covers the costs incurred in various stages of water production process — collection of rainwater, treatment of raw water and distribution of treated potable water to customers through an extensive island-wide network of water pipelines. The Water Tariff is charged based on the volume of water consumed.

Water Conservation Tax

The Water Conservation Tax (WCT) was introduced in 1991 to encourage water conservation and to reflect its scarcity value. WCT is imposed as a percentage of the water tariff to reinforce the message that water is precious from the very first drop.

Waterborne Fee

Every drop of used water is collected via a separate network of sewers and channelled to the water reclamation plants for treatment, after which it is further purified into NEWater or discharged into the sea.

The Waterborne Fee (WBF) goes towards meeting the cost of treating used water and maintaining the used water network. It is charged based on the volume of water usage.

For further information on Domestic Households Water Prices, visit the PUB website here.

Tax Exemption Schemes for Start-Ups

The tax exemption scheme for new start-up companies and partial tax exemption scheme for companies are tax reliefs available to reduce companies’ tax bills.

The tax exemptions for qualifying companies for their first 3 consecutive YAs are as follows:

-

75% exemption on the first $100,000 of normal chargeable income*; and

-

A further 50% exemption on the next $100,000 of normal chargeable income*.

* Normal chargeable income refers to income to be taxed at the prevailing Corporate Income Tax rate of 17%.

Tax Exemption on First $200,000 of Chargeable Income

_edited.jpg)

The maximum exemption for each YA is $125,000 ($75,000 + $50,000).

Qualifying Conditions for Tax Exemption Scheme for New Start-Up Companies

All new start-up companies are eligible for the tax exemption scheme, except:

-

Companies whose principal activity are that of investment holding

-

Companies that undertake property development for sale, investment, or both

The new start-up company must also:

-

Be incorporated in Singapore

-

Be a tax resident of Singapore for that YA

-

Have its total share capital beneficially held directly by no more than 20 shareholders throughout the basis period for that YA where:

-

All the shareholders are individuals; or

-

At least 1 shareholder is an individual holding at least 10% of the issued ordinary shares of the company

-

Tax Concessions for Royalty

Royalty is earned in Singapore if it is:

-

paid directly or indirectly by a person resident in Singapore or by a permanent establishment in Singapore; or

-

deductible against any income earned in or derived from Singapore.

Qualifying for tax concession

To qualify for the tax concession, the royalties must be received for:

-

any literary, dramatic, musical or artistic work; or

-

approved intellectual property or approved innovation.

If you qualify, you will be taxed on the lower of:

-

amount of royalties after allowable deductions; or

-

10% of the gross royalties.

The tax concession does not apply to royalties received for any work published in:

-

any newspaper;

-

periodical;

-

approved intellectual property or innovation (from Year of Assessment 2017).

Life Insurance Relief

You may claim Life Insurance Relief for the Year of Assessment 2022 if you satisfy all these conditions:

1. Your total contributions for the following in 2021 was less than $5,000;

a. compulsory employee CPF contribution;

b. self-employed Medisave/voluntary CPF contribution; and

c. voluntary cash contribution to your Medisave account.

2. You paid insurance premiums in 2021 on your own life* insurance policy; and

3. The insurance company must have an office or branch in Singapore if your policies are taken on or after 10 August 1973.

As long as the individual (SC/PR/Foreigner) is a tax resident in Singapore and meets the qualifying conditions, he can claim tax reliefs, including the life insurance relief.

Supplementary Retirement Scheme

(SRS)

The Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

Contributions to SRS are eligible for tax relief.

Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who derive any form of income may make SRS contributions in the current year. You must be:

-

At least 18 years of age;

-

Not an undischarged bankrupt;

-

Not having a mental disorder; and

-

Capable of managing yourself and your affairs.

You and/or your employer (on your behalf) may contribute at any time, and as often as you like, subject to the maximum SRS contribution for the year. Contributions must be made in cash.

You may withdraw funds from your SRS account any time. Withdrawals can be made:

-

- in cash;

-

- in the form of investments for the qualifying types of withdrawal.

Withdrawals in the form of monies or investment from your SRS Account are subject to income tax and added to your other taxable income (e.g. employment, rental).

When a foreigner or Singapore Permanent Resident withdraws from his SRS account, the withdrawal is subject to withholding tax.

Parenthood Tax Rebate

Married, divorced or widowed parents may claim tax rebates of up to $20,000 per child.

As PTR is a one-off rebate, you may only claim PTR on a qualifying child once.

Qualifying for rebate

PTR is given to tax residents to encourage them to have more children.

To qualify, you must be a Singapore tax resident who is married, divorced or widowed in the relevant year.

You may use the PTR Eligibility Tool (XLSM, 52KB) to check your eligibility for PTR.

Amount of rebate

You and your spouse may share the PTR based on an apportionment agreed by both of you. If your percentage of PTR claimed does not add up to 100% or you are unable to agree on the apportionment, we will apportion the PTR equally between the both of you.

Child Order | PTR (For child born from 2008 onwards) |

|---|---|

1st

2nd

3rd

5th child and subsequent

4th

$10,000

$20,000

$20,000

$20,000 per child

$5,000

Earned Income Relief

Earned Income Relief is for individuals who are gainfully employed or carrying on a trade, business, profession or vocation.

Qualifying for relief

You will receive Earned Income Relief if you have taxable earned income from any of the following sources in the previous year:

Amount of relief

The amount of Earned Income Relief is based on your age and taxable earned income (less any allowable expenses) in the previous year.

* If the amount of taxable earned income is lower than the maximum amount claimable, the relief will be capped at the amount of taxable earned income.

For example, if you are 55 years old as at 31 Dec 2021 and have taxable earned income of $5,000 in 2021, you will get Earned Income Relief of $5,000 (instead of $6,000) for the Year of Assessment 2022.

Spouse Relief/

Handicapped Spouse Relief

Qualifying for relief

You may claim Spouse Relief in the Year of Assessment 2023 if you have supported your spouse and satisfy all these conditions in 2022:

Legally separated spouses

If you are legally separated from your wife, you may claim this relief if you have made maintenance payments under a Court Order or Deed of Separation.

Divorced spouses

Divorced taxpayers who pay alimony to their former spouses are not eligible to claim this relief.

Amount of relief

Central Provident Fund(CPF)

Relief for employees

CPF Relief is given to encourage individuals to save for their retirement. Employees who are Singapore Citizens or Singapore Permanent Residents may claim CPF Relief. To understand more about CPF, please refer to Access to CPF.

Amount of relief

CPF Relief is capped by the amount of compulsory employee CPF contributions made on Ordinary Wages and Additional Wages under the CPF Act.

The amount of CPF Relief is capped to ensure that CPF is not used as a tax shelter.

You may claim CPF Relief for making employee CPF contributions on wages that have not exceeded the Ordinary Wage ceiling and Additional Wage ceiling.

For more information on OW ceiling and AW ceiling, please refer to CPF Board's website.

Family Tax Office Structure

The concept of a ‘family office’ does not have a fixed definition. Typically, it is conceptualised as an entity which provides a variety of services that a family may need.

-

The new conditions explicitly require a minimum fund size of S$10 million at the point of application and the fund must commit to increase its AUM to S$20 million within a two-year grace period.

-

The minimum fund size for Section 13U Tax Incentive Scheme (s13U Scheme) remains unchanged at S$50 million at the point of application.

s13O Scheme –

Currently, the s13O Scheme only required the fund to be managed or advised directly by a fund management company (FMC) in Singapore, where the FMC holds a capital markets services licence pursuant to the Securities and Futures Act 2001 (SFA) or is exempt from the requirement to hold such a licence under the SFA.

From 18 April 2022, the fund must now be managed or advised directly throughout each year by a family office in Singapore, where the family office employs at least two Investment Professionals. An Investment Professional includes:

-

portfolio managers;

-

research analysts; and

-

traders;

-

who are earning more than S$3,500 per month; and

-

must be engaging substantially in the qualifying activity.

If the family office is unable to employ two Investment Professionals at the point of application, the fund is given a one-year grace period to employ the second Investment Professional.

s13U Scheme – The fund must also be managed or advised directly throughout the year by a family office in Singapore, where the family office employs at least three Investment Professionals. More importantly, one of the three Investment Professionals must be a non-family member of the beneficial owner(s). The same definition of “family” discussed above is applied here as well. If the family office is unable to employ one non-family member as an Investment Professional at the point of application, the fund is given a one-year grace period to do so.

It should be noted that Investment Professionals must be tax resident in Singapore.

Donations and Tax Deductions

Fun fact: Did you know? In Singapore, for every $1 you donate to the Community Chest or any IPC, $2.50 will be deducted from your taxable income for the year!

Donate to Community Chest or any approved Institution of a Public Character (IPC) before the year ends, and enjoy tax deductions of 2.5 times the qualifying donation amount next tax season.

-

Cash Donations

-

Shares Donations

-

Computer Donations

-

Artefact Donations

-

Donations under the Public Art Tax Incentive Scheme (PATIS)

-

Land and Building Donations

For more information on donations and tax deductions, please refer to IRAS’ website.

https://www.iras.gov.sg/taxes/other-taxes/charities/donations-tax-deductions

Compulsory Medisave Contributions

Compulsory Medisave Contributions

You must make compulsory contributions to your Medisave Account after you receive a Notice of Computation (NOC) of CPF Contributions from IRAS if:

-

You are a self-employed person;

-

You are a Singapore Citizen or Permanent Resident; and

-

Your net trade income# is more than $6,000.

#Net trade income is your gross trade income minus all allowable business expenses, capital allowances and trade losses.

Amount of Compulsory Medisave Contributions

The Medisave amount that you have to contribute yearly depends on your:

-

age;

-

income level; and

-

net trade income for the previous year.

The Medisave contribution amount is generally a percentage of your total business trade income subject to a maximum cap.

Medisave Contribution Rates for Year 2017

Age as at 1 Jan 2017

Yearly Net Trade Income

Example: 37 year-old with net trade income of $65,000 in 2017

Age as at 1 Jan 2017

37 years old

Net Trade Income in 2017

$65,000

Medisave Contribution Rate:

9%

Maximum Cap for Age Group

$6,480

Amount of Medisave Contribution Payable

$5,850

Lower of $6,480 or (9% x $65,000)

For more Medisave contribution rates, please refer to the CPF Board website.

Voluntary Contributions to Medisave Account (VC-MA)

You may also make voluntary contributions to your Medisave account and claim tax reliefs to lower your taxes.

Tax Relief for Voluntary Contributions

You may claim tax relief for your voluntary Medisave contributions if:

-

You are a Singapore Citizen or Permanent Resident;

-

You have made voluntary contributions to your Medisave account in the previous year; and

-

You derived any source of income (e.g. from rental, director's fees, etc.) in the year you made the voluntary contributions.

Avoidance of Double Taxation Agreement (DTA)

Juridical double taxation results when the same income is being taxed twice - once in the jurisdiction where the income arises and another time in the jurisdiction where the income is received.

Juridical double taxation results when the same income is being taxed twice - once in the jurisdiction where the income arises and another time in the jurisdiction where the income is received.

Jurisdictions enter into DTAs to mitigate the effects of double taxation. A DTA partner refers to a jurisdiction which has signed a DTA with Singapore.

Only the tax residents of Singapore and the respective DTA partner can enjoy the benefits of a DTA.

Benefits Under DTAs

Depending on the provisions of the DTA, you may claim the benefits of an exemption from the tax on income for personal services, teachers, researchers, artistes, athletes, students, trainees, etc.

Tax Residents of DTA Partners

If you are a tax resident of a jurisdiction that has concluded a DTA with Singapore, you may be protected from being taxed twice on the same income in Singapore.

Singapore has signed Avoidance of Double Taxation Agreements (“DTAs”), limited DTAs and Exchange of Information Arrangements (“EOI Arrangements”) with around 100 jurisdictions.

You can find the list of jurisdictions here.

Singapore has no Capital Gains Tax

Non-taxable gains from sale of property, shares and financial instruments

The following gains are generally not taxable:

-

Gains derived from the sale of a property/fixed assets in Singapore as it is a capital gain.

-

Profits or losses derived from the buying and selling of shares or other financial instruments are viewed as personal investments (capital transactions on foreign exchange)

-

Payouts from insurance policies as they are capital receipts.

Taxable gains from sale of property

The gains may be taxable if you buy and sell property with a profit-seeking motive or deemed to be trading in properties.

Some criteria used to assess if you are trading in properties are as follows:

-

- Frequency of transactions (buying and selling of properties);

-

- Reasons for buying and selling of property;

-

- Financial means to hold the property for long term; and

-

- Holding period.

Reporting gains from sale of property

You must declare taxable gains from the sale of property under 'Other Income' in your Income Tax Return. If you are unsure whether your gains from sale of property are taxable, please email us.

You do not need to declare gains that are not taxable in your Income Tax Return.

Enhanced Tier Fund Exemption Scheme (ETF Scheme)

The ETF Scheme has a number of qualifying conditions and requires the approval of the MAS.

The qualifying conditions include:

• the fund must have a minimum fund size of S$50 million at the time of application;

• the fund must be managed or advised by the relevant family office;

• the family office must employ at least 3 resident investment professionals in Singapore who are substantively engaged in an investment management or advisory role; and

• the fund must incur at least S$200,000 in business spending in Singapore.

The ETF Scheme has been extended to all forms of fund vehicles, including a Singapore VCC.

Approval under the ETF Scheme is ultimately at the discretion of the MAS and therefore cannot be guaranteed even if all qualifying conditions are satisfied.

The ETF Scheme is generally granted to a fund entity upon an application being approved by MAS. Once granted, exemption will take effect from the date of application and available for the life of the IHC fund (based on the terms of the approval).

Tax exemption applies to all specified income from designated investments as the terms are defined for the purposes of the tax exemption.

There are however many different ways to structure the family office and the fund entity(ies).

Singapore Resident Fund Scheme

The Singapore Resident Fund Scheme was introduced to encourage fund managers to base their fund vehicles in Singapore, by giving Singapore based funds the same tax exemptions given under the offshore fund regime (e.g. to a Cayman Islands fund).

Successful applicants under the 13R and 13X schemes will be granted employment passes (one for 13R and three for 13X), which can offer an interim solution pending permanent residency applications.

13R and 13X funds that are approved for the tax incentive scheme before 31 December 2024 can enjoy the benefits of the scheme for the life of the fund, provided that the on-going operational conditions for the entities are met.

Family offices set up under the 13R and 13X scheme can also utilise the new Variable Capital Company (VCC) structure. A VCC can be set up as a standalone fund, or as an umbrella fund with two or more sub-funds. A VCC structure is regarded as a single company, with a single identity for tax purposes, removing the need for multiple tax returns.

Shares of a VCC are redeemable at the fund’s net asset value (NAV), and VCCs can pay dividends from the capital, which is not typically allowable in other forms of corporate vehicles. In addition, VCC shareholders register will not be publicly available, offering privacy to investors.

Information is from Sovereign Group and PWC

Requirements:

-

Company must be incorporated and tax resident in Singapore

-

S$200,000 in expenses per annum

-

No minimum fund size requirement

Non-qualifying investors are subject to a financial penalty, which is the percentage held by the beneficial owner in the fund x the amount of income derived by the fund x the income tax rate applicable to the fund had the income not be en exempt (i.e., 17% for a company)

Annual declarations to MAS required Annual statements to investors required Declaration to IRAS required if financial penalty applies. Tax returns and corporate filings required (the MAS has informally clarified that new changes may be implemented to allow annual statements to be issued to only non-qualifying investors)

Information is from EDB